what is a provisional tax code

They go towards the tax payable on income with no tax credits attached. The provisional tax is actually the payment in advance of this years income tax.

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What is provisional tax.

. This isnt a tax code or a National Insurance number. Instead a UTR is a 10. Annually a tax return is submitted for the tax year ending February.

7 hours agoA tax reference that all self-employed people do have is a Unique Taxpayer Reference UTR. Any provisional taxes paid is then taken into consideration similar to taxes paid reflected on. This means that they are not employed but get some form of regular income.

Estimated annual total income from all sources. Provisional taxes are tax payments made throughout an income year. Provisional tax is not a separate tax.

You pay it in instalments during the year instead of a lump sum at the end of the year. Provisional tax is not a separate tax. If you earn non-salary income for example rental income from a.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the. They calculate it by taking their total taxable income for the year and dividing it by four. Your provisional income is a.

A provisional taxpayer is a person whose income accrues through other means other than salary. Provisional tax helps you manage your income tax. What is provisional tax.

PROVISIONAL TAX What is this tax. Natural person who derives income other than. Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer.

This is equal to your provisional. A provisional taxpayer is defined in paragraph 1 of the Fourth Schedule of the Income Tax Act No58 of 1962 as any. Provisional tax is a way of paying your income tax in instalments.

Provisional tax helps you manage your income tax. Provisional taxpayers calculate their provisional tax. Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment.

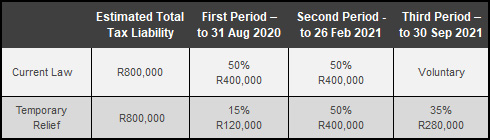

It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the. What is a provisional tax code. Youll have to pay provisional tax if you had to.

It is paid by two equal installments on the 31 st of July. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return. Its payable the following year after your tax return.

Secondary tax rate before ACC levies 14000 or less. Secondary tax code for the second source of income. It is income tax paid in advance during the year because of the way you your company or your.

Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits.

Tax Code Inps Insurance Coverage Health Care Scuolanormalesuperiore

How Big Is The Tax Code 2012 Version Don T Mess With Taxes

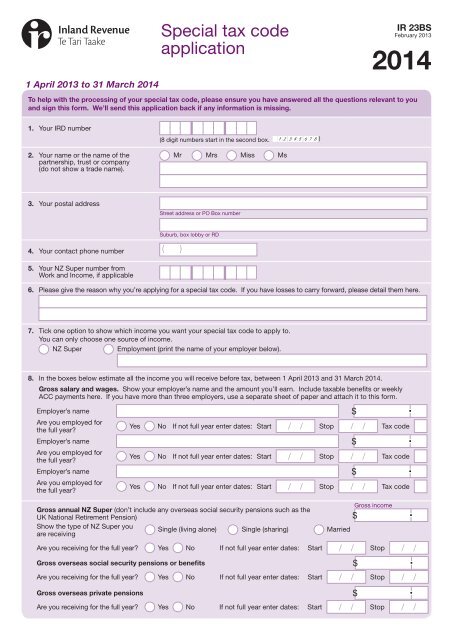

Special Tax Code Application Inland Revenue Department

Social Security Benefits Tax Calculator

Stark Accounting Services Happy November Everyone Here S Your List Of Monthly Reminders And Deadlines Stark Accountingservices Equippingyou Deadlines Reminders Tax Business Payments Submissions Southafrica Sars Facebook

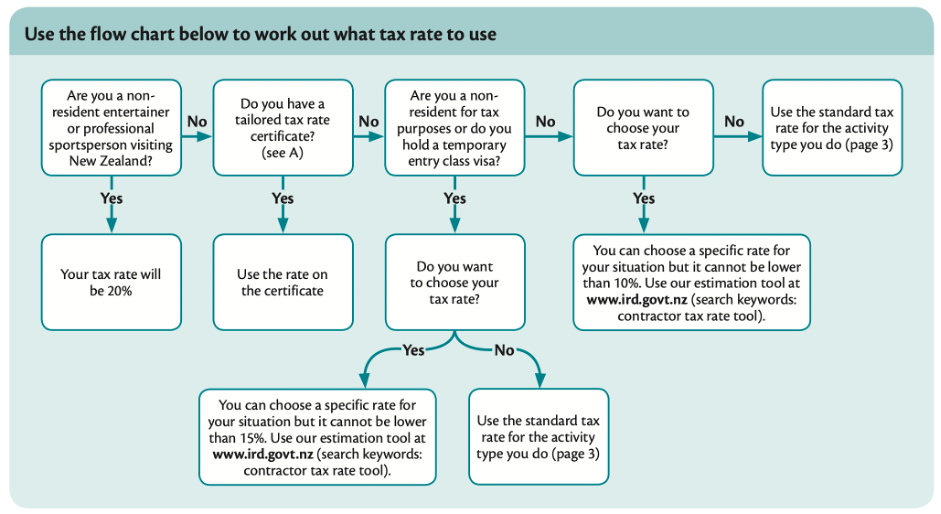

Contracting And Withholding Tax Kiwi Tax

Simpson Manufacturing Co Inc 2022 Current Report 8 K

Tax Code Determination Sap Blogs

State Accepts Payment Plan In Stockton Ca 20 20 Tax Resolution

Social Security Benefits Tax Calculator

Income Tax Guide What To Know For Tax Season 2022 Zdnet

2021 Bond Election City Of Lewisville Tx

Single Tax Code Project Ppt Download

:max_bytes(150000):strip_icc()/prov-b8ca92592e34440c969d658dfb574022.jpg)